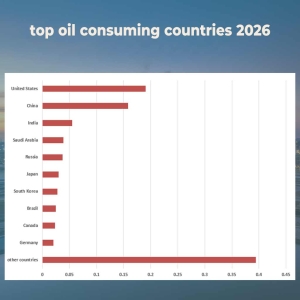

Top 10 oil consuming countries 2026: Global Energy Giants

In 2026, the global energy market is defined by industrial growth in Asia and efficiency gains in the West. This report analyzes the top 10 oil consuming countries, highlighting how shifting demand for petroleum products like diesel and bitumen impacts global prices and infrastructure.

You can also see the list of the largest oil producers in the article ‘The Largest Oil Producers in 2026‘.

Table: Top 10 Oil Consuming Countries in 2026

| Rank | Country | Consumption (Million Barrels/Day) | Global Share (%) |

| 1 | United States | 20.25 | 19.1% |

| 2 | China | 16.70 | 15.8% |

| 3 | India | 5.85 | 5.5% |

| 4 | Saudi Arabia | 4.10 | 3.9% |

| 5 | Russia | 3.90 | 3.7% |

| 6 | Japan | 3.15 | 3.0% |

| 7 | South Korea | 2.95 | 2.8% |

| 8 | Brazil | 2.65 | 2.5% |

| 9 | Canada | 2.40 | 2.3% |

| 10 | Germany | 2.10 | 2.0% |

| Total | World Consumption | ~105.90 | 100% |

1. United States

-

Status: The world’s largest consumer and producer.

-

Production: Dominant, producing roughly 20.5 million b/d (including NGLs).

-

Imports: Despite being a powerhouse, it remains a major importer of heavy crude from Canada and Mexico to satisfy its specialized Gulf Coast refineries.

-

Main Use: Transportation remains king, with a massive appetite for Gasoline and diesel, though NGLs for the petrochemical industry are the fastest-growing segment.

2. China

-

Status: Major producer, but the world’s largest net importer.

-

Production: Significant at around 4.3 million b/d.

-

Imports: Primarily sourced from Russia, Saudi Arabia, and Iraq. In 2026, China is also aggressively building its Strategic Petroleum Reserve (SPR).

-

Main Use: While EV adoption is slowing gasoline growth, China is the global leader in using oil for petrochemicals to produce synthetic fibers and base oil.

3. India

-

Status: The global “Engine of Growth” for oil demand.

-

Production: Small producer (~0.6 million b/d); 85% dependent on imports.

-

Imports: Heavy reliance on Russia (its top supplier in 2026), followed by Iraq and Saudi Arabia.

-

Main Use: Industrialization and agriculture drive a massive need for diesel, while Kerosene remains vital for specific industrial processes and rural lighting.

4. Saudi Arabia

-

Status: A top oil exporting country and massive domestic consumer.

-

Production: Leading OPEC+ player (~9-10 million b/d).

-

Imports: Virtually zero crude imports.

-

Main Use: Unlike most, the Kingdom uses crude oil directly for Electricity Generation to power air conditioning, as well as for its rapidly expanding domestic chemical plants.

5. Russia

-

Status: Major producer and consumer.

-

Production: Approximately 9.0 million b/d.

-

Imports: None; it is a self-sufficient exporter.

-

Main Use: Domestic heating and industrial transport. Russian refining also yields high volumes of sulfur as a byproduct, which is essential for global fertilizer production.

6. Japan

-

Status: Almost entirely dependent on imports.

-

Production: Negligible.

-

Imports: Over 90% comes from the Middle East (UAE, Saudi Arabia, and Kuwait).

-

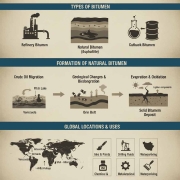

Main Use: High-tech manufacturing and specialized fuels. Japan is a major consumer of bitumen for its advanced, high-durability road networks.

7. South Korea

-

Status: Major importer and refining hub.

-

Production: None.

-

Imports: Primarily from the USA, Saudi Arabia, and Iraq.

-

Main Use: It operates some of the world’s largest refineries, converting crude into high-value petroleum products and naphtha for the global electronics and plastic industries.

8. Brazil

-

Status: Rising producer and steady consumer.

-

Production: Robust growth, reaching nearly 3.7 million b/d.

-

Imports: Imports light oils and specialized lubricants from the USA.

-

Main Use: Transportation is the primary driver, though Brazil leads the world in “Flex-fuel” technology where oil-based fuels compete with biofuels.

9. Canada

-

Status: Major producer (Oil Sands).

-

Production: Roughly 6.0 million b/d.

-

Imports: Imports from the USA for its Eastern refineries due to pipeline geography.

-

Main Use: Heavily used in mining, industrial heating, and long-distance logistics across its vast territory.

10. Germany

-

Status: Importer; negligible production.

-

Imports: Has shifted away from Russia, now sourcing mostly from Norway, the USA, and Kazakhstan.

-

Main Use: Primarily for the “Mittelstand” (industrial sector) and as a logistics hub for Europe, requiring steady supplies of aviation fuel and heavy distillates.

Quick Comparison: Consumption by Product Type

| Product | 2026 Primary Demand Source |

| Gasoline | Personal mobility (Highest in USA/Brazil) |

| Diesel | Freight and Heavy Industry (Highest in China/India) |

| Bitumen | Infrastructure & Road Construction (Highest in Japan/China) |

| Petrochemicals | Plastics and Medical Supplies (Highest in South Korea/China) |

A key takeaway from the 2026 data is China’s Strategic Petroleum Reserve (SPR). Even though their internal gasoline demand is plateauing due to EV dominance, their crude imports remain high at 16.7M b/d because they are aggressively stockpiling. With the IEA forecasting a supply surplus of nearly 2.5M to 3M b/d this year, do you expect oil prices to stabilize around the $60 mark, or will geopolitical tensions in the Middle East keep a high risk premium?

Hello Marcus! You’ve hit on a vital point. The 2026 market is indeed a “tug-of-war” between a physical supply glut and geopolitical volatility. While the surplus suggests lower prices ($58-$62 range according to EIA), any friction in the Strait of Hormuz—which handles over 25% of global seaborne oil—could instantly erase that surplus. At Universal Trades, we advise our clients to use flexible supply contracts to hedge against these sudden 2026 price spikes.