The Largest Petroleum Product Producing Countries

Crude oil, often called “black gold,” plays a vital role in shaping the global economy and daily life. This energy source not only supplies fuel for transportation and electricity generation but also serves as the primary feedstock for chemical and petrochemical industries, making it a strategic commodity.

Beyond fuel, petroleum products are used in manufacturing plastics, clothing, fertilizers, medicines, and insulators. Fluctuations in crude oil prices, driven by supply shocks or geopolitical events, can increase production costs in non-energy sectors, leading to global inflation and impacting consumer purchasing power and even food security. Understanding these complex interconnections is crucial for comprehensive energy market analysis.

Crude oil is a mixture of hydrocarbons that, after extraction, is transported to refineries. There, through processes like distillation and catalytic cracking, it’s transformed into valuable products. Refinery capabilities in processing various types of crude oil (light/heavy, sweet/sour) directly affect the final product mix and profitability. Advanced refineries can convert heavier, often cheaper, crude oil into more valuable products, giving countries a significant competitive advantage in the global market and strengthening their strategic position in petroleum product trade.

Petroleum Products: From Crude Oil to Final Products

Crude oil is a hydrocarbon liquid formed deep within the earth over millions of years from the remains of marine organisms like zooplankton and algae, under high heat and pressure. This vital raw material, once extracted from oil fields, is transported to refineries to be converted into usable products. The importance of crude oil extends beyond mere fuel production; it is also widely used as a raw material for petrochemical industries. Crude oil is utilized in the production of plastics, chemical fertilizers, synthetic fibers, rubber, pesticides, perfumes, and dyes, underscoring its central role in modern life.

Refineries, as the pulsating heart of the oil industry, play a critical role in the oil value chain. These industrial centers transform crude oil into useful and consumable products through complex processes such as distillation, catalytic cracking, and hydrocracking. This process allows for the separation of different hydrocarbons and the production of a wide range of products. In analyzing the position of countries in the petroleum product market, a country’s refining capacity (the amount of crude oil it can process) is as important as its crude oil production. For example, countries like Japan and South Korea, despite having minimal domestic crude oil production, are key players in this market due to their enormous refining capacities and their ability to import crude oil and then export petroleum products. This distinction shows that a “petroleum product producer” does not necessarily mean a “crude oil producer,” but rather refers to a country’s ability to convert crude oil into valuable products. This emphasizes the strategic importance of refining infrastructure and geopolitical position for imports and exports in global energy security.

Introduction and Applications of Key Petroleum Products

Petroleum products encompass a wide range of goods, each with its specific applications. Here are some of the most important ones:

Gasoline:

Gasoline is one of the primary products derived from crude oil through the refining process. In the early days of the oil industry, gasoline was considered a waste and hazardous material, but with the boom in the automotive industry, the demand for this product sharply increased, and today it has become the most important petroleum product. Gasoline is mainly used as fuel in the internal combustion engines of cars, motorcycles, light trucks, and boats.

Gasoil (Diesel):

Gasoil, also known as diesel fuel, is used as fuel in diesel engines. This product is the main fuel for trucks, buses, trains, boats, and ships. The sulfur content in gasoil is typically higher than in kerosene.

Fuel Oil (Heavy Fuel Oil):

Fuel oil, also known as heavy fuel, is obtained from the distillation of crude oil and has high viscosity and density. Due to its low price and high heating value, fuel oil is primarily used in power plants for energy generation, in industrial boilers, and as the main fuel for large ships. However, burning fuel oil has significant negative environmental and human health impacts due to the presence of toxic compounds and the emission of greenhouse gases like carbon dioxide and sulfur.

Jet Fuel (Jet Kerosene):

Jet fuel is an oil cut whose boiling range, after gasoline, falls between 150 and 275 degrees Celsius. The majority of kerosene produced globally is converted into jet fuel. Jet fuel is divided into two main categories: A and A1 (common global standards) and Jet Fuel B (a mixture of kerosene and gasoline with a lower freezing point for use in very cold weather).

LPG (Liquefied Petroleum Gas):

LPG stands for Liquefied Petroleum Gas. This gas is colorless and odorless, but a specific odor is intentionally added to it to detect potential leaks. LPG is produced from the refining of crude oil in refineries or from natural gas and is easily liquefied under pressure for storage and transport in steel cylinders. This product has wide applications in cooking, domestic and industrial heating, and as vehicle fuel.

Kerosene (Lamp Oil):

Kerosene is a colorless liquid, slightly heavier than gasoline, obtained from the crude oil refining process. In the first 50 years of the oil industry, kerosene was the most important petroleum product and was used as lamp oil for lighting. However, today, its primary application has shifted to jet fuel for aircraft.

Bitumen (Asphalt):

Bitumen is a black, sticky substance obtained during crude oil refining and also occurs naturally in some oil-rich regions, seeping out from cracks in the ground. This material can range in softness to hardness and has highly diverse applications. Its most important uses include road construction (asphalt for roads and airport runways), waterproofing (roofs, tunnels, bridges, dams, and building foundations), manufacturing industries (production of adhesives, paints, coatings, and electrical insulation), marine industries (coating ship hulls and docks), and even artistic and decorative applications.

Base Oil and Lubricants:

Base oil is the main component in the preparation of various oil products, acting as a base or carrier. These oils are produced from different sources, such as the refining of crude oil (mineral base oil) or through chemical synthesis (synthetic base oil). Lubricants, of which base oil constitutes the majority, are used to reduce friction and wear in industrial machinery, engines, and moving parts of vehicles. Although lubricants account for less than 2% of total petroleum products, they are widely used in industries and modern life and are vital for the proper functioning and longevity of equipment.

Naphtha:

Naphtha refers to a class of volatile and flammable liquid hydrocarbon fuels that are positioned between light gases (like LPG) and kerosene in the crude oil distillation column. The majority of natural gas condensates also consist of naphtha. Naphtha is the main feedstock for the petrochemical industry for producing plastics (such as ethylene), detergents, solvents, polishes, and varnishes. It can also be converted into high-octane gasolines and other petroleum fuels using catalytic processes.

Paraffin:

Paraffin is a saturated hydrocarbon compound found as a soft, white, or colorless solid at room temperature, obtained from petroleum or other natural sources. The general chemical formula for paraffins is CnH2n+2. This substance has wide applications in candle making, cosmetics, wax production, and even in the rubber industry.

Petroleum Coke:

Petroleum coke, also known as petcoke, is a byproduct of crude oil refining, produced by the thermal decomposition of heavy oil hydrocarbons at high temperatures and pressures. This carbonaceous solid is grayish-black with a honeycomb appearance and is insoluble in organic solvents. Petcoke is used as fuel (especially in catalytic cracking processes) and also in the production of carbon electrodes (for aluminum recovery), carbon brushes, silicon carbide abrasives, and structural carbon (such as pipes).

The Largest Petroleum Product Producing Countries

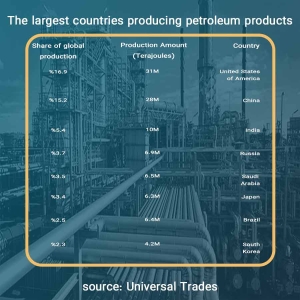

Analyzing the position of countries in petroleum product production requires careful attention to data sources. Data on petroleum product production is collected from reputable sources such as the International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA). This data is often expressed in terajoules (TJ), indicating the energy content of the products, or million barrels per day. For a more comprehensive analysis, IEA data for 2022 and 2023 has been used, showing petroleum product production in terajoules and as a percentage of total global production.

A crucial point in this analysis is the vital distinction between “crude oil production” and “refined petroleum product production.” Many sources refer to crude oil production (which also includes other petroleum liquids and biofuels). While these countries are major crude oil producers, they are not necessarily equally leading in the production of refined products, as a significant portion of their crude oil is exported as raw material. In contrast, countries like Japan and South Korea, despite negligible domestic crude oil production, are among the largest producers of refined products due to their immense refining capacities and crude oil imports. This difference indicates that a country’s power and influence in the global energy market are not solely determined by its crude oil reserves, but its refining capacity, technological sophistication in processing different types of crude oil, and its strategic position for importing and exporting refined products are equally, if not more, important for its role as a “petroleum product producer.” This emphasizes the importance of refining infrastructure in energy security and global trade and can lead to shifts in geopolitical power dynamics from merely raw material producers to processing and distribution hubs.

Factors Influencing Petroleum Product Production

Refinery Capacity and Operational Complexity

The capacity and complexity of refineries are key determinants in petroleum product production. Refineries operate differently based on their capabilities in processing various types of crude oil (light/sweet versus heavy/sour) and producing a specific mix of products. Light, sweet crude oil has lower sulfur content and is easier to process, allowing for the production of valuable products like gasoline and ultra-low sulfur diesel through simple distillation. In contrast, heavy, sour crude oil contains higher amounts of sulfur and impurities, making its processing more expensive and requiring more specialized equipment. However, complex refineries often prefer to use heavy or sour crude oil for diesel refining, as this can provide better profit margins. Investments in advanced refining technologies not only help increase efficiency but also enhance refineries’ ability to adapt to changes in input crude oil quality and market demand for final products.

Globally, the trend of migrating refining capacity from developed to developing countries, particularly in Asia-Pacific, Africa, and the Middle East, continues. These regions are witnessing a significant increase in new refining capacities, which is altering the dynamics of global petroleum product production. For instance, approximately 6.3 million barrels per day are expected to be added to global refining capacity, with the majority (3.2 million barrels per day) in Asia-Pacific, 1.4 million barrels per day in Africa, and 1.2 million barrels per day in the Middle East. This expansion of capacity highlights the increasing role of these regions in supplying global petroleum products.

Market Demand and Product Mix

Market demand is a decisive factor in the product mix produced by refineries. Gasoline and ultra-low sulfur diesel constitute nearly 70% of the output from a barrel of refined crude oil, and consumer demand for them is very high. Refineries adjust their product mix based on prevailing market demand. For example, refining infrastructure in the United States is primarily designed for gasoline production due to the country’s heavy reliance on passenger vehicles. In markets with lower gasoline demand, refining operations tend to shift more towards the production of marine fuels or other petroleum products required by the local economy.

Global events and geopolitical developments also have profound impacts on the demand and prices of petroleum products. The COVID-19 pandemic in 2020 severely reduced energy demand and drove crude oil prices to historic lows. As the global economy recovered, prices surged again. The Russian invasion of Ukraine in 2022 also led to a sharp increase in oil prices, demonstrating the market’s vulnerability to geopolitical shocks. These fluctuations compel refineries to adapt their capacity, operations, and product mix to maintain profitability.

Global Trade of Petroleum Products

International trade of petroleum products involves a complex network of exports and imports influenced by refining capacities, regional demand, and geopolitical factors. In 2023, the total value of global petroleum product exports reached $975.4 billion. The United States was the top exporter with $112.9 billion (11.6% of total global exports), followed by India with $85 billion (8.7%), the Netherlands with $72 billion (7.4%), Singapore with $57 billion (5.8%), and South Korea with $50.9 billion (5.2%). These five countries collectively accounted for 38.7% of total global exports. From a continental perspective, Asian exporters led with 48.5% of global sales, while Europe followed with 33.3% and North America with 13.6%.

In terms of imports, the European Union was the top importer with $80.59 billion, followed by the United States with $69.02 billion, Singapore with $53.12 billion, Australia with $35.43 billion, and the Netherlands with $32.33 billion in 2023. These statistics highlight the interdependence of countries in energy supply and the vital role of petroleum product trade in global energy security.

Maritime transit routes for oil and petroleum products, known as “chokepoints,” play a crucial role in global trade. The Strait of Malacca with 23.7 million barrels per day and the Strait of Hormuz with 20.9 million barrels per day were among the most important chokepoints in 2023. The Strait of Hormuz alone accounted for more than a quarter of all seaborne oil traded in 2023. Any disruption in these routes can have profound impacts on global petroleum product supply and pricing.

Outlook and Future Trends in the Petroleum Product Industry

The petroleum product industry is on the cusp of significant transformations shaped by technological advancements, geopolitical shifts, and the global move towards clean energy.

Technological Developments and Innovations

One of the main trends in the refining industry is the increasing use of carbon emission reduction technologies. Oil refineries are increasingly employing carbon capture and storage (CCS) methods to reduce their carbon dioxide emissions. This process involves capturing CO2 at the emission point and transporting it to a monitored storage site to prevent its release into the atmosphere. Large projects are underway worldwide with the capacity to capture approximately 40 million tons of CO2 per year, demonstrating the potential of this technology in reducing greenhouse gas emissions.

Additionally, Gas-to-Liquids (GTL) technology is expanding, converting natural gas into high-quality petroleum products such as transportation fuels, engine oils, naphtha, and diesel. Using natural gas as an alternative to crude oil offers benefits including cleaner fuel, abundance, versatility, and cost-effectiveness. Byproducts from GTL technology are colorless, odorless, and have minimal impurities, making them suitable for producing plastics, detergents, and cosmetics.

In the aviation sector, the production of Sustainable Aviation Fuels (SAF) is rapidly growing. Although global SAF production accounted for only 0.53% of jet fuel consumption in 2024, this amount is expected to increase significantly in the coming years. SAF supply agreements and investments in new technologies demonstrate the aviation industry’s commitment to reducing its carbon footprint.

Geopolitical Shifts and Energy Security

The decisions and operations of major oil companies significantly shape global energy markets. These companies play a vital role in determining energy supply, pricing, and the future of energy sustainability. Their influence extends across industries, economies, and consumer behavior, creating ripple effects in how energy is perceived and consumed globally. Organizations like OPEC+ also directly impact global oil supply through their decisions on production quotas.

Energy-rich countries often use these resources as powerful geopolitical tools to influence international relations and pursue their strategic interests. Control over these resources can lead to geopolitical tensions as countries compete for access to energy sources and transit routes. Energy dependencies create complex relationships between producers and consumers, with oil and gas flows shaping foreign policies and diplomatic interactions.

Shift Towards Clean Energy and its Impact on Demand

With growing concerns about climate change, the oil industry faces increasing responsibility for managing its environmental impacts. Oil companies play a dual role: balancing the profitable production of fossil fuels with investments in clean and renewable energy. Measures such as carbon capture and storage, investments in solar and wind projects, and collaborations with research institutions demonstrate their gradual shift towards green energy.

Despite these developments, the petroleum product market continues to grow. The global refined petroleum products market size is projected to increase from $2777.4 billion in 2024 to $2906.39 billion in 2025, representing a compound annual growth rate (CAGR) of 4.6%. This growth during the forecast period can be linked to factors such as increased urbanization, rising demand for crude oil and gas, and the growing need for electricity. Key trends expected during this period include a focus on expanding new facilities and increasing production capacities, product innovation, increased investments, and growth in mergers and acquisitions. This indicates that despite pressures to transition to clean energy, petroleum products will continue to play a vital role in meeting global energy needs.

Conclusion

The petroleum product industry is the backbone of the global economy, not only providing fuel for transportation and industries but also supplying essential raw materials for the production of countless consumer goods. An analysis of the largest petroleum product producing countries shows that the United States and China have been leading in recent years, with a significant share of global production. India, Russia, Saudi Arabia, Japan, Brazil, South Korea, Canada, and Germany are also among the top ten countries. A crucial point in this analysis is the distinction between crude oil production and refined petroleum product production; countries like Japan and South Korea, despite minimal crude oil production, are major players in the production of final products due to their immense refining capacities. This emphasizes the strategic importance of refining infrastructure, and not merely oil reserves, in energy security and global trade.

The dynamics of the petroleum product market are influenced by multiple factors, including the capacity and complexity of refineries, regional and global demand, and geopolitical developments. Maritime transit routes also play a vital role in global trade flows. In the future outlook, the oil industry faces challenges and opportunities arising from technological innovations such as carbon capture and storage and GTL technology, as well as the global shift towards clean energy. Despite these developments, forecasts indicate continued growth in the petroleum product market, underscoring the enduring and vital role of these products in meeting global energy and industrial needs in the coming decades. This industry is constantly adapting and evolving to both meet energy demands and move towards greater sustainability.

Why can fluctuations in crude oil prices lead to global inflation

Crude oil not only supplies fuel for transportation and electricity but also serves as a primary raw material for the chemical and petrochemical industries. Fluctuations in crude oil prices, due to supply shocks or geopolitical events, can increase production costs in many non-energy industries, consequently leading to global inflation and impacting purchasing power and food security.