Top 10 Oil & Gas Companies of 2026

The following rankings are based on integrated performance, including revenue, production capacity, and market capitalization as of early 2026.

1. Saudi Aramco (Saudi Arabia)

Saudi Aramco remains the undisputed titan of the industry. As the state-owned jewel of the Kingdom of Saudi Arabia, it boasts the lowest extraction costs globally. In 2026, Aramco continues to expand its downstream capabilities, focusing heavily on petrochemical integration to hedge against potential fluctuations in raw crude demand.

-

Investment Perspective: Aramco is the ultimate “stability play.” While its dividend policy is subject to state requirements, its massive reserves and diversification into blue ammonia and hydrogen make it a long-term cornerstone for any energy portfolio.

2. ExxonMobil (United States)

ExxonMobil has reclaimed its position as the premier Western major. By doubling down on the Permian Basin and its high-margin Guyana assets, the company has seen a significant boost in its production profiles.

-

Investment Perspective: Exxon is currently a favorite for those seeking aggressive share buybacks and a robust dividend yield. Their recent acquisition of Pioneer Natural Resources has consolidated their dominance in U.S. shale.

3. Shell plc (United Kingdom)

Based in London, Shell has successfully pivoted to lead the global Liquefied Natural Gas (LNG) market. As Europe continues to seek alternatives to piped Russian gas, Shell’s infrastructure remains a critical component of regional energy security.

-

Investment Perspective: Shell is an ideal pick for investors looking for exposure to the “transition bridge.” Their focus on LNG and integrated power provides a buffer that pure-play oil companies lack.

4. China National Petroleum Corporation – PetroChina (China)

As the primary producer for the world’s second-largest economy, PetroChina’s scale is nearly unmatched. They are currently leading the charge in integrating renewable energy (solar and wind) directly into their oilfield operations to lower the carbon intensity of their barrels.

-

Investment Perspective: While offering massive scale, investors should be mindful of geopolitical risks and the company’s alignment with Chinese state policy.

5. Chevron Corporation (United States)

Chevron remains a model of capital discipline. In 2026, they are heavily focused on the Tengiz expansion in Kazakhstan and their significant shale holdings.

-

Investment Perspective: Chevron is often viewed as the “safer” American alternative to Exxon, with a very strong balance sheet and a focus on returning cash to shareholders rather than over-leveraging for growth.

6. Total Energies (France)

The French major is perhaps the most “multi-energy” of the group. They have aggressively expanded into offshore wind and solar while maintaining a high-performing upstream portfolio in Africa and the Middle East.

-

Investment Perspective: Total Energies is the best choice for ESG-conscious investors who still want the reliable cash flows generated by oil and gas.

7. BP plc (United Kingdom)

After a period of strategic recalibration, BP has found its footing in 2026 by balancing high-return oil projects with “convenience and mobility” retail growth.

-

Investment Perspective: BP offers a high-risk, high-reward profile compared to its peers. Their success depends on their ability to execute their “Performing while Transforming” strategy effectively.

8. Equinor (Norway)

Equinor is the standard-bearer for low-carbon oil and gas production. Leveraging Norway’s vast continental shelf, they provide the bulk of Western Europe’s natural gas.

-

Investment Perspective: Equinor is a defensive play. Its deep-water expertise and leadership in carbon capture and storage (CCS) make it a resilient pick for a decarbonizing world.

9. Eni S.p.A. (Italy)

Eni has distinguished itself through a “fast-track” exploration model, particularly in Africa (e.g., Mozambique and Egypt). They have become a key player in the Mediterranean’s emerging gas hub.

-

Investment Perspective: Eni is suitable for investors seeking exposure to emerging markets and high-growth natural gas discoveries.

10. ConocoPhillips (United States)

As a pure-play exploration and production (E&P) company, ConocoPhillips is the most sensitive to crude price movements. Their low-cost supply of gasoline and kerosene feedstocks makes them a lean, efficient operator.

-

Investment Perspective: This is the “oil price lever.” If you believe oil prices will surprise to the upside, ConocoPhillips typically offers the most direct leverage among the majors.

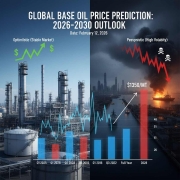

Market Outlook: Will Crude Oil Prices Increase?

As we analyze the data for 2026, the short-to-medium term outlook suggests a downward pressure on prices. According to recent reports from the EIA and IEA, global production—led by the U.S., Saudi Arabia, and Russia—is currently outpacing demand.

-

Price Forecast: Most analysts, including myself, expect Brent crude to average between $58 and $65 per barrel for the remainder of 2026. This is a decline from the $70+ averages seen in previous years.

-

The “Bull” Case: A price increase would likely only be triggered by significant geopolitical disruptions in the Middle East or a faster-than-expected economic recovery in China.

For a deeper dive into these trends, you can explore our detailed Crude oil price forecast in 2026.

Key Industry Resources

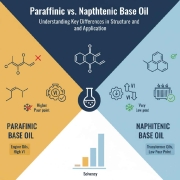

To better understand the logistical and chemical side of the industry, it is essential to monitor the production and trade of secondary petroleum products. The demand for industrial materials like bitumen for infrastructure and sulfur (a byproduct of desulfurization) remains a key indicator of global economic health.

If you are looking for geographical data, see our lists of:

Leave a Reply

Want to join the discussion?Feel free to contribute!