The Impact of Trump Administration Policies on Iran’s Oil Industry

The policies of Donald Trump’s administration could have a significant impact on Iran’s oil industry and consequently on the Iranian economy. In this article, we examine the effects of the Trump administration’s policies, particularly the severe sanctions, on Iran’s oil industry. The US withdrawal from the JCPOA in 2018 drastically reduced Iran’s oil exports, putting significant pressure on the Iranian economy. To circumvent the sanctions, Iran explored new methods such as utilizing a “shadow fleet” and selling oil to China. This article also analyzes the long-term consequences of these sanctions and the future of Iran’s oil industry.

Iran’s Oil Industry in the Global Arena:

With the fourth-largest proven oil reserves and the second-largest natural gas reserves globally, Iran plays a crucial role in the world’s energy market. Any changes in Iran’s oil policies can affect oil prices in international markets. The new US administration, aiming to limit Iran’s nuclear program and regional influence, imposed sanctions on Iran’s oil industry. The goal of these sanctions was to completely halt Iran’s oil exports. This article examines the impact of these sanctions on Iran’s production, exports, and economy. It also analyzes Iran’s methods for coping with the sanctions and potential future scenarios.

Iran’s Oil Industry

Historical Development

Iran’s oil industry has a rich history marked by the struggle for national control over its resources. This journey began in 1901 with the D’Arcy Concession, leading to the discovery of oil in 1908 and the establishment of the Anglo-Persian Oil Company in 1909. From 1914 for the next 37 years, the British government controlled the oil industry. The 1933 agreement also deprived Iran of control over its oil exports. However, pressures for nationalization in 1951, led by Dr. Mossadegh, resulted in the formation of the National Iranian Oil Company (NIOC).

The 1953 coup and a new agreement in 1954 saw a multinational consortium replace the Anglo-Persian Oil Company. The Islamic Revolution in 1978 fully nationalized the oil industry, emphasizing the historical importance of oil for Iran’s sovereignty and economic development.

Current Structure and Organization

Iran’s oil industry is centrally managed by the government, with the National Iranian Oil Company (NIOC) as the primary entity operating under the Ministry of Petroleum. NIOC is responsible for all oil and gas-related activities, from exploration to export. In addition to NIOC, other state-owned companies such as the National Iranian Gas Company (NIGC), the National Iranian Oil Refining and Distribution Company (NIORDC), and the National Petrochemical Company (NPC) 1 also play roles in the industry. Iran’s constitution prohibits foreign or private ownership of natural resources, reinforcing the government’s control over this sector.

Production Capacity and Key Oil Fields

Iran’s oil industry comprises 40 active oil fields, with 27 of these located in the southwestern province of Khuzestan, near the Iraqi border. Among these, the Ahvaz oil field holds a special position due to its largest oil reserves, followed by the Gachsaran and Marun fields, which are also highly significant.

Prior to the reimposition of sanctions in 2018, Iran’s crude oil production capacity was consistently around 3.8 million barrels per day. However, the return of sanctions and a decrease in foreign investment led to a decline in crude oil production.

Despite the challenges posed by sanctions, Iran continues its efforts to increase its crude oil production. These sanctions have deprived Iran of access to global markets, financial resources, and advanced technologies, which are crucial for maintaining and developing oil fields. Consequently, fully realizing the potential of the country’s vast oil reserves has become challenging.

Natural Gas Reserves and Their Interaction with the Oil Sector

In addition to its enormous crude oil reserves, Iran holds the world’s second-largest natural gas reserves. Natural gas plays a significant role in meeting the country’s domestic energy needs, supplying over 70% of Iran’s total energy consumption. Moreover, gas condensates from Iran’s gas fields, particularly the South Pars field, constitute a substantial portion of the country’s hydrocarbon production.

This large volume of natural gas reserves, besides meeting domestic needs, also provides the country with the potential for hydrocarbon exports. Therefore, natural gas can partially mitigate the negative economic effects of sanctions imposed on the crude oil industry.

Economic Significance of Iran’s Oil Industry

Contribution to Iran’s GDP

Oil production is a fundamental pillar of Iran’s economy. According to available statistics, approximately 23% of the country’s GDP was derived from this sector, although this figure decreased to 16% in the Iranian year 1403 (March 2024 – March 2025).

In years such as 2008, nearly 55% of the government’s revenue came from the sale of oil and natural gas. These figures indicate that despite efforts to diversify the economy, a significant portion of the government’s financial resources remains dependent on oil. Such dependence makes Iran’s economy highly vulnerable to fluctuations in global oil prices and the negative consequences of sanctions. In other words, any reduction in exports or a drop in oil prices can directly impact the government’s financial stability and its ability to implement economic programs.

Oil Revenue and the National Budget

Historically, a considerable portion of Iran’s government budget was dependent on oil revenues. However, the imposition of sanctions severely impacted this vital source, leading to financial difficulties for the government.

In particular, the “maximum pressure” campaign initiated by the Trump administration specifically targeted Iran’s oil revenues. The aim of these actions was to create economic pressure on Iran and compel it to change its policies.

The decline in oil revenues has forced the Iranian government to make difficult decisions, ranging from reducing public spending to trying to find alternative sources of income or managing budget deficits. Each of these options can have negative consequences for the country’s economy and affect its overall stability.

Role in Foreign Exchange Earnings

Oil exports have always been Iran’s primary source of foreign exchange earnings, playing a crucial role in financing imports and maintaining balance in international payments. However, the sanctions imposed by the United States government have significantly limited this source of income.

The decrease in foreign exchange earnings due to restrictions on oil exports has severely impacted Iran’s ability to import goods and services. This can put further pressure on the economy and increase the likelihood of shortages of essential resources.

Since foreign currency is essential for paying for imported goods and services, the limitations on oil exports have reduced access to foreign exchange resources, consequently making imports more expensive and increasing the potential for shortages of basic goods.

Outlook for Iran’s Oil Products

Major Refineries and Refining Capacity

Currently, Iran’s oil refineries have a daily refining capacity of 3.6 million barrels of oil. Major and prominent Iranian refineries include those in Abadan, Imam Khomeini, and Bandar Abbas. The Star Refinery in the Persian Gulf, as the main center for processing gas condensates, is also of particular importance.

However, many of Iran’s refineries, built before the Islamic Revolution in 1978, require modernization and the adoption of advanced technologies. Despite a significant oil refining capacity, the age of some facilities and their focus on producing products such as bitumen and fuel oil may lead to reduced efficiency and non-compliance with international standards.

The use of outdated technologies in refineries can lead to a decrease in the production of value-added products and an increase in low-quality products. This directly negatively impacts Iran’s ability to export high-quality refined products as well as the quality of domestic fuel consumption.

Greater focus on the production of high-quality gasoline and diesel, in addition to increasing export capabilities, can also play a significant role in improving air quality within the country.

Key Oil Products

Iran’s refineries produce a wide range of petroleum products, including gasoline, diesel, jet fuel, fuel oil, bitumen, and industrial oils. Additionally, raw materials such as naphtha, liquefied petroleum gas (LPG), and ethane, which are essential for the petrochemical industries, are also supplied by these refineries.

However, a significant portion of the crude oil refined in Iran is allocated to the production of fuel oil and bitumen. The high production of fuel oil, which is considered a low-value and polluting fuel, compared to higher-value fuels like gasoline and diesel that meet international standards, highlights the need for improvements in refining technologies. Such technological upgrades would not only benefit the country’s economy but also have positive effects on the environment.

Domestic Consumption and Export of Refined Products

Iran ranks eleventh among the world’s consumers of petroleum products, with subsidized fuel prices within the country being a major contributing factor to this high consumption.

The sanctions imposed by the Trump administration had a significant impact on Iran’s ability to export refined petroleum products. For example, reports indicate that Iran’s gasoline and diesel exports almost reached zero in 2021.

This combination of high domestic consumption due to subsidized prices and restrictions on crude oil exports, which is the raw material for refineries, has led to a decrease in the export of refined petroleum products, even with the country’s significant refining capacity.

Furthermore, sanctions directly create a major obstacle to the export of refined petroleum products by limiting access to international markets and disrupting production and transportation networks. This has a significant negative impact on the country’s economy.

The Donald Trump Administration’s “Maximum Pressure” Campaign

Withdrawal from the JCPOA and Re-imposition of Sanctions

In May 2018, the United States, under the presidency of Donald Trump, announced its withdrawal from the Joint Comprehensive Plan of Action (JCPOA), an international agreement designed to limit Iran’s nuclear program. Following this decision, the United States began the process of reinstating sanctions that had been lifted or suspended under the JCPOA. These sanctions targeted key sectors of Iran’s economy, particularly the oil and financial industries, which are vital for the country’s economic stability and international trade.

The withdrawal from the JCPOA marked a fundamental shift in US policy towards Iran. This change moved from a period of engagement and sanctions relief under the JCPOA to a new strategy based on intense economic pressure. The JCPOA had provided Iran with significant relief from international sanctions in exchange for its commitment to limit its nuclear activities. However, the Trump administration’s decision to exit the agreement effectively reversed these economic benefits and created new economic challenges for Iran.

Key Sanctions Targeting Oil Exports and Iran’s Financial Sector

The Trump administration implemented sanctions that specifically targeted Iran’s oil exports and its access to the global financial system. These measures included a ban on the purchase of Iranian oil and severe restrictions on international financial transactions, limiting Iran’s access to the global financial network.

Additionally, sanctions were imposed on individuals and entities involved in facilitating transactions with Iran, reducing international trade and investment in the Iranian economy. The primary goal of these sanctions was to drastically reduce Iran’s oil revenues and create significant obstacles for the country’s oil exports and economic activities.

Efforts to Drive Iran’s Oil Exports to Zero

One of the main objectives of the Trump administration’s “maximum pressure” campaign was to bring Iran’s oil exports to zero. This action was designed to cripple Iran’s economy and force it to renegotiate the nuclear agreement and change its regional behavior. A complete halt to oil exports would deprive Iran of a significant portion of its foreign exchange earnings, which were crucial for economic stability and financing imports and government expenses.

Sanctions Against Entities Facilitating Iran’s Oil Trade

To achieve this goal, the United States imposed sanctions on individuals, companies, and vessels involved in the purchase, transportation, and storage of Iranian oil. These sanctions particularly targeted entities operating in countries such as China, the UAE, and India. The United States also focused on disrupting the “shadow fleet” of Iranian oil tankers used to secretly transport oil. These measures were aimed at dismantling the networks and mechanisms that Iran had established to circumvent the sanctions.

Analysis of the Impact of Trump’s Policies

Crude Oil Production and Exports

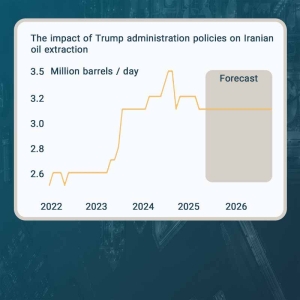

The implementation of the Trump administration’s “maximum pressure” campaign had a significant impact on Iran’s crude oil production and exports. Before the re-imposition of sanctions in 2018, Iran’s oil production capacity was around 3.8 million barrels per day. However, after the sanctions, oil exports decreased from 2.5 million barrels per day in 2017 to about 350,000 barrels per day in 2020.

Despite the sharp decline, Iran managed to maintain limited exports by using unconventional methods such as a “shadow fleet” of tankers and ship-to-ship transfers. China also contributed to this by continuing to import Iranian oil, albeit at discounted prices. The sanctions also led to reduced demand and limitations on Iran’s oil production due to limited storage capacity. However, China’s willingness and the use of alternative strategies allowed for the continuation of some exports.

Percentage of the oil industry in GDP

The decline in oil exports and production had a significant and noticeable impact on the oil sector’s share of Iran’s Gross Domestic Product (GDP). During the peak of the sanctions, between 2018 and 2020, Iran’s economic growth turned negative, clearly indicating a diminished role for the oil sector within the economy.

Conversely, with the increase in oil exports under the Biden administration, the oil sector’s contribution to GDP improved. This reliance of the Iranian economy on oil revenues underscores the direct effect of sanctions in reducing income and causing economic contraction. On the other hand, the rise in oil exports helped to foster positive economic growth, highlighting the pivotal role of the oil sector in Iran’s economy.

Production and Export of Refined Petroleum Products

The Trump administration’s sanctions targeted not only crude oil but also Iran’s oil refining and petrochemical sectors, limiting the production and export of refined products. These measures pushed Iran to focus more on meeting domestic needs.

Reports indicate a significant decrease in the export of diesel and gasoline, while adhering to international standards for some products posed challenges. By targeting the entire oil supply chain, these sanctions reduced Iran’s ability to refine and export, thereby limiting potential energy revenues. The focus on domestic consumption and product quality issues likely marginalized the export of refined fuels.

Challenges and Adaptations

Faced with the intense sanctions from the Trump administration, Iran employed various strategies to continue exporting oil. These actions included utilizing a “shadow fleet” of oil tankers and engaging in ship-to-ship transfers to conceal the origin of shipments.

Iran also resorted to exporting oil to China at discounted prices to maintain this crucial trade relationship. There are also reports of Iranian oil being rebranded under the names of other countries like Iraq, the UAE, Oman, and Malaysia before being sold to smaller Chinese refineries. These measures demonstrate Iran’s resilience in finding alternative methods for oil exports, despite severe sanctions.

The development of these mechanisms highlights the limitations of unilateral sanctions in completely halting oil exports from a major global producer.

Iran’s Oil Industry Without Trump’s Policies

Projected Production and Export Levels in the Absence of Sanctions

Had the Trump administration not withdrawn from the JCPOA and reinstated sanctions in 2018, Iran’s oil production and exports would likely have continued their previous trend. Oil exports could have remained in the range of 2.5 to 2.8 million barrels per day, and with continued international engagement and foreign investment, production capacity could have gradually increased.

This scenario could have allowed Iran to maintain its position as a significant global exporter, generating greater oil revenues for the government. These revenues could have played an effective role in economic development and the realization of national priorities.

Potential for Foreign Investment and Technological Advancement

Prior to the US withdrawal, the JCPOA had created favorable conditions for foreign investment in Iran’s oil and gas sector. The continuation of this agreement could have led to the attraction of international capital and expertise, modernizing Iran’s oil infrastructure, increasing production capacity, and improving refining technology.

Foreign investment typically brings not only financial resources but also technical knowledge and best practices, which are essential for optimizing oil extraction and enhancing refinery efficiency. These advancements could have resulted in the production of higher-quality petroleum products, increased exports of refined fuels, and strengthened Iran’s position in the global energy market.

Impact on Iran’s GDP and Economic Growth

The higher oil revenues that could have been achieved without the Trump administration’s sanctions would likely have had a positive impact on Iran’s GDP and economic growth. The negative economic growth experienced during the sanctions period could likely have been avoided.

Greater revenues would have increased the government’s financial flexibility, allowing for investment in various economic sectors, the implementation of social programs, and increased imports of essential goods and services. These factors could have contributed to higher GDP growth. Furthermore, the international trade and investment facilitated by the JCPOA would have helped to expand the economy and improve employment rates and the quality of life for Iranian citizens.

Comparison with the Actual Situation Under Sanctions

The economic situation under the Trump administration’s “maximum pressure” campaign was starkly different from a scenario without sanctions. Iran experienced a significant decline in its oil exports, leading to economic contraction and reduced foreign investment.

Iran faced serious challenges in maintaining production capacity and accessing international markets, resorting to unconventional and less profitable methods, such as reliance on a primary buyer in China. Although sanctions did not completely halt Iran’s oil exports, they created severe limitations that had adverse economic consequences for the country.

Comparing these two situations highlights the profound impact of the “maximum pressure” policy on Iran’s oil industry and economy.

Conclusion: Long-Term Consequences and Future Outlook

The policies of the Trump administration, particularly the “maximum pressure” campaign, had far-reaching effects on Iran’s oil industry. These policies led to a sharp decrease in crude oil production and exports, which harmed the oil sector’s contribution to the country’s GDP and economic growth. Iran faced significant challenges in maintaining production capacity and accessing international markets, becoming reliant on unconventional methods such as the “shadow fleet” and discounted exports to China.

This dependence on China and unconventional trade methods created complexities and potential risks for Iran’s oil sector. In the future, Iran’s oil industry will likely remain influenced by US sanctions policies and global political shifts. Foreign investment to maintain and increase Iran’s oil production capacity, and OPEC’s role in managing supply disruptions, will be key factors in the long-term outlook for this industry. The interplay of these factors will shape the future trajectory of Iran’s oil industry and its position in the global energy market.

“Your article provides a deep and insightful analysis of the impact of the Trump administration’s policies on Iran’s oil industry. The comprehensive coverage of its history, structure, capacities, and, most importantly, the consequences of sanctions, makes this article an extremely valuable source of information. The sections discussing Iran’s strategies for circumventing sanctions and comparing the scenario with and without sanctions are particularly illuminating and engaging. This is an excellent resource for understanding the challenges facing Iran’s oil industry and its impact on the country’s economy.”